The Crypt0l0g1st is a curated weekly newsletter regarding Blockchain, web3, defi, gamefi, crypto investments and other.

The first decentralized NFT launchpad and marketplace on the Theta network

On May 10, 2022, OpenTheta announced the launch of Theta's NFT Digital Rights Management (DRM) technology.

Through this, NFT DRM said it will allow content creators to directly manage content distribution. NFT DRM cannot validate and revoke access to content in the form of NFT. It also provides reliability to content creators because only users who have obtained the appropriate NFT can access the content represented by that NFT.

For more information on Theta's OpenTheta launch, here

INVESTIGATION INTO MARKET MANIPULATION AND THE RECENT MOON CRASH

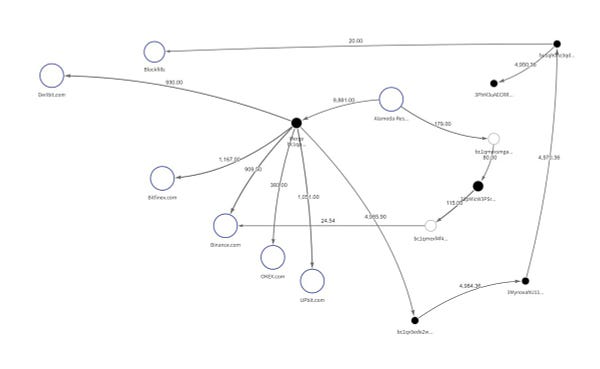

Someone nicknamed Baron-Bear-Hayes is threatening to launch an investigation into the vulture activities of @SBF_FTX, @AlamedaTrabucco and @AlamedaResearch.

As well as the manipulation of @CryptoHayes and how he was allowed to withdraw client funds after hours on Bitmex at 13-14 GMT.

This is a serious private investigation into the work of fraudsters in the banking industry and intelligence agencies to manipulate the cryptocurrency market.

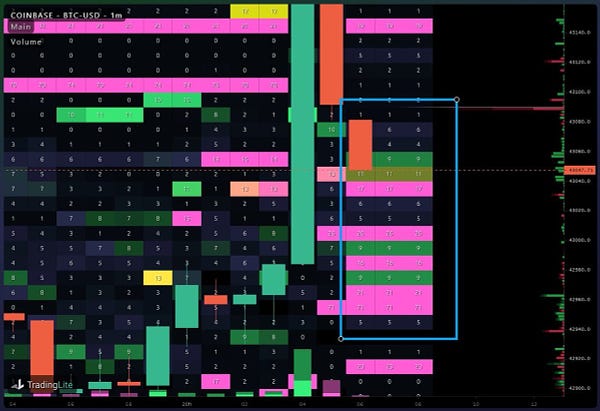

Deribit, Binance, Bitfinex, Okex, Upbit. Money flowed through the scheme, see figure TW The most interesting aspect is the whale warning system that cryptocurrency enthusiasts have long talked about and suspected.

Overall, this is interesting material to study. Very useful for those who believe in TA and do not understand that there is a whole gang of manipulators in the market, covered by security services and government regulators.

😈Bear Baron Hellspawn @hellspawncrypto

I will start a decentralized blog soon! I will expose all @SBF_FTX and @AlamedaTrabucco and @AlamedaResearch . As well early days with @CryptoHayes market manipulations and how he was allowed to withdrawal funds out of #Bitmex off withdrawal hour (13-14PM UTC).THE MAJOR HOLDERS OF BITCOIN

In the midst of a market decline due to the recent aftermath of the Terra collapse, the amount of bitcoin held on exchanges briefly surged on May 7, jumping more than 2 percent from 2.481 million to 2.532 million bitcoins. But soon after Terra's collapse, the number of bitcoins on exchanges began a rapid decline and remains lower today than at any time in history.

Bitcoin held on trading platforms continues to fall below 68 percent of the current total issuance and is now well below the lows recorded on November 15, 2020. And 248 days earlier, on March 12, 2020, the day after the infamous Black Thursday, just over 3 million bitcoins were held on centralized exchanges.

Then, in a short period of time, the amount of BTC held on exchanges dropped by 15.86 percent, from 3 million BTC on March 12 to 2,524 BTC on Nov. 15, 2020.

For the first time ever, there were 2.481 million BTC on the exchanges on May 2, 2022, down 1.70% from November 15, 2020. However, there was a brief spike in BTC deposits sent to exchanges amid a decline in Terra blockchain and terrausd (UST).

After the May 2 low, there was a brief 2 percent increase in BTC deposits, but this fell quickly from a high of 2.532 million bitcoins on May 7, dropping 2.21 percent to 2.476 million BTC during the week.

Small holders put BTC into the exchanges to sell urgently in hysteria, while large holders bought down and withdrew BTC in their wallets. This is why the whole attack was concocted. The goals were twofold: destroy stabelcoins and take BTC out of weak hands.

Coinbase currently holds 853,530 or 34 percent of all bitcoins traded worth $25.14 billion. Binance owns 13.58 percent of the bitcoins deposited on the exchanges. This is 340,410 BTC worth about $10 billion.

Okex is in third place with 266,530 BTC or 10.62 percent of the total. Huobi Global now occupies the fourth position with 160,950 bitcoins. Huobi's portfolio contains 6.39 percent of exchange-traded BTC.

Kraken is the fifth largest BTC holder with 102,900 BTC or 4.07 percent.

In total, the top five exchanges hold 1,724 million BTC, worth $50.7 billion, out of a total of $73.7 billion held in cryptocurrency wallets.

Although it cannot be ruled out that Robert Kiosaki's prediction will come true (https://news.bitcoin.com/rich-dad-poor-dads-robert-kiyosaki-thinks-bitcoin-could-bottom-out-at-9k-reveals-why-he-remains-bullish/) and before reaching a new ATN, bitcoin will see a bottom at $9K.

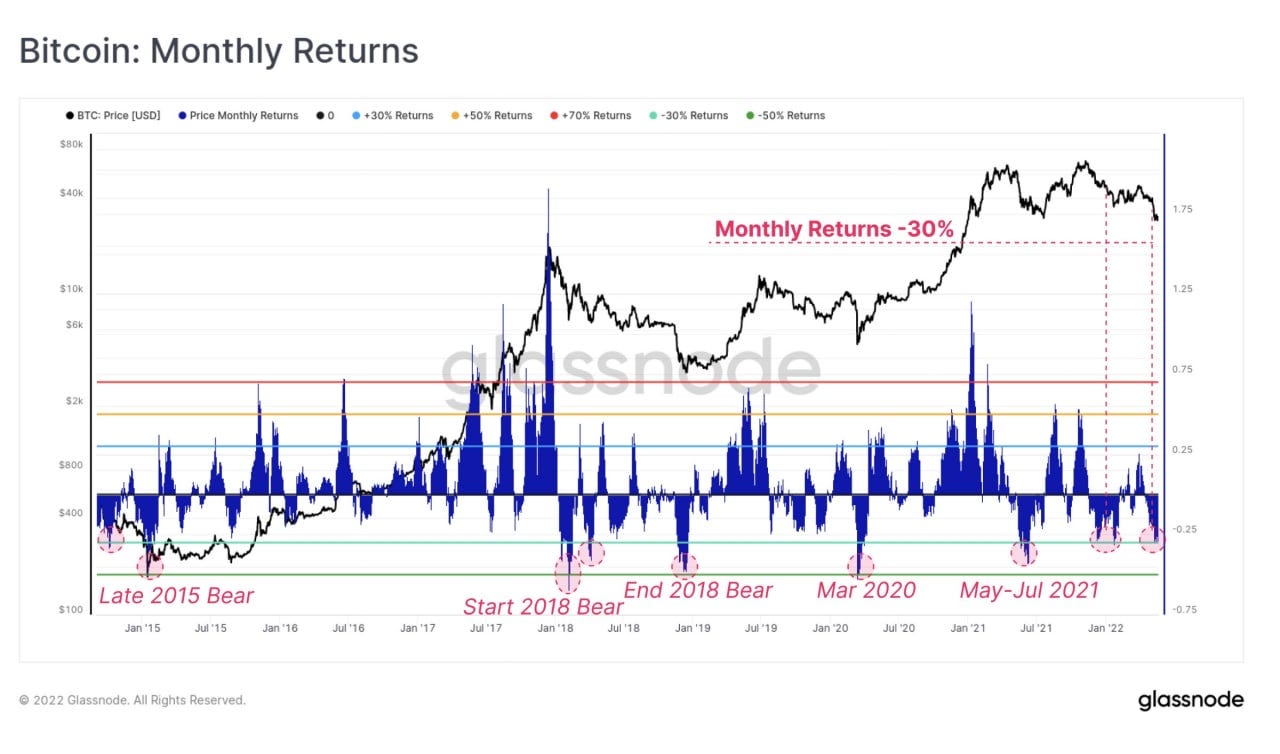

BITCOIN MONTHLY RETURNS

Given the low price performance, scary derivative prices, and extremely weak demand for both Bitcoin and Ethereum, one can conclude that there is little willingness to act on the demand side. Those who want to buy on the downside do not yet believe that THE MOMENT has arrived.

Top 5 Community-Driven Cryptocurrencies in 2022: Monero

Monero is the most popular anonymous cryptocurrency on the market. The Monero cryptocurrency was created based on the ByteCoin blockchain, developed in 2014. A cryptocurrency using the CryptoNote protocol, the mechanisms which make the blockchain completely anonymous. CryptoNote utilizes ring-signature and stealth-addresses technologies. Thanks to these technologies, the transaction participants can hide all the information: who, to whom, and how much was transferred. However, due to the high anonymity of the coin, financial regulators from different countries impose bans on its circulation. Because of this, the listing of Monero had to be abandoned by some crypto exchanges.

Monero is a community-driven cryptocurrency where each participant can contribute to the development of the project. On the official website, contributors can find detailed information and explore many ways to help the project. For example, you can join one of more than ten workgroups that contribute to the project. For example, community members who have coding skills can join the Development Workgroup. And participants who want to help the project become publicly available can join the Localization Workgroup and help translate the Monero-related documentation.

https://simplehold.io/blog/article/top-5-Community-driven-cryptocurrencies-in-2022?utm_source=social&utm_medium=reddit&utm_campaign=education_post

INCH<>TRAVALA

inch Network announced a partnership with Travala, a popular online bookmaking service.

In the near future, the platform will also offer the opportunity to pay for services with 1INCH tokens. Paying with 1INCH will save holders up to 40%.

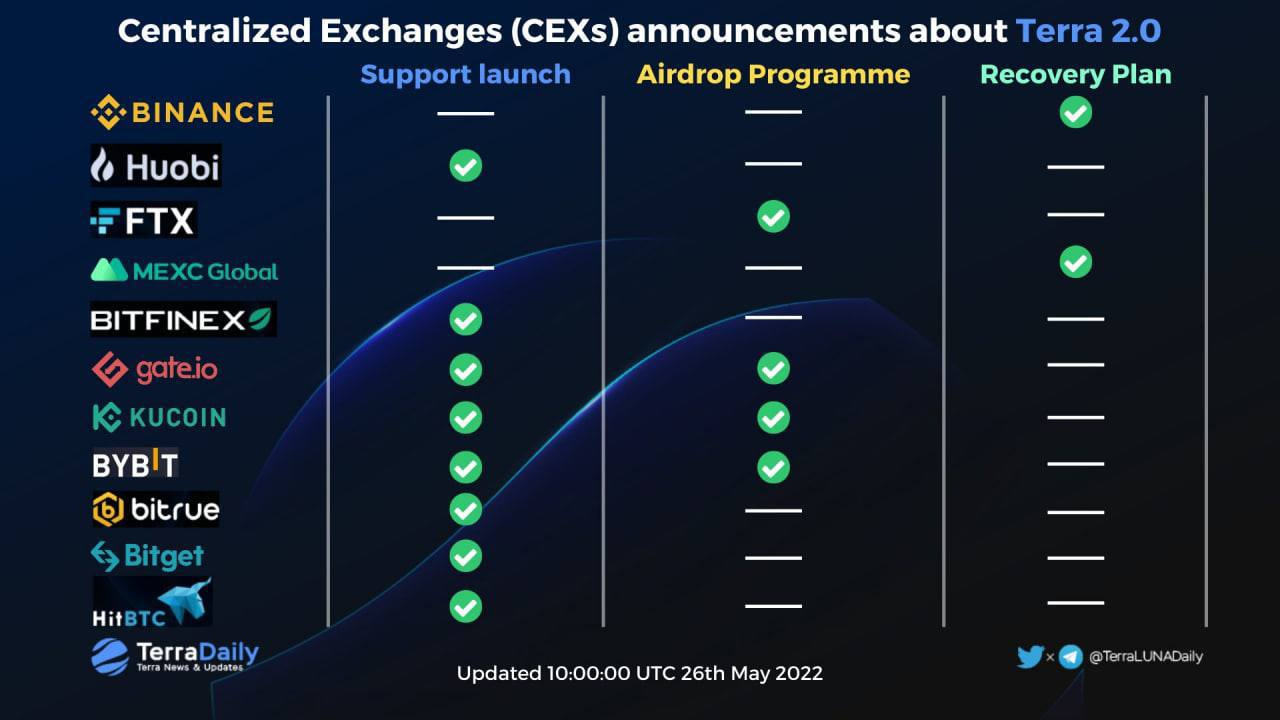

Exchanges supported Terra 2.0

Donate

If you like the newsletter and want more of this content, then shout me a round of beers by donating some spare Monero.

Scan this code to send Monero to 46SbfdpwXTKPV47hewFFAtN1tsAR7hLF5ZAURbxcmBQXVRhCwHMG4FdCyFn2yUU1FhNrZimh874f2UV3Rho336ZQM44sF1G.

Past Issues