Proof of Stake Business Opportunities

Currently, Bitcoin and Ethereum's block chains are using a process that requires energy named Proof-of-Work, in order to assure that all transitions on the web are valid and that the distributed network record is accurate.

PoW (a consensus algorithm for btc and eth), has proven, over the past years, to be a safe and reliable protocol, there are no reports of successful attacks on the bitcoin chain and as long as there are enough honest participants, the aggression to the hash power will be substantially limited to zero.

Although PoW appears to be safe and reliable, the algorithm introduced by Satoshi Nakamoto seems to have lost its appeal since critics highlight its energy-consuming aspects and its tendency towards centralized mining pools, indeed a common criticism to the PoW’s mining industry claims that it encourages the centralisation of resources and therefore of security providers.

But a more scalable and efficient system, especially from an energy point of view, is increasingly attracting the interest of the main blockchain development teams, such as Ethereum for instance, which is transitioning from Proof-of-Work to Proof-of-Stake, meaning a different way to ensure the blockchain’s security where investors, in exchange for rewards, can block their funds.

Countless PoS projects are in fact heading towards a huge growth thanks to their promises of energy efficiency and major decentralization, growing both in terms of interest, as new horizons of the algorithmic consensus and in terms of new business opportunities.

Beside a substantial technological difference, it should be emphasized how a PoS network also creates by default economic opportunities, since it encourages Stakers to contribute to its own security.

In the PoS network, stakeholders are rewarded by the sum of transaction fees and by the value of the network inflation, which can be thought of as the primary incentive that encourages users to put to use their own cryptographic resources.

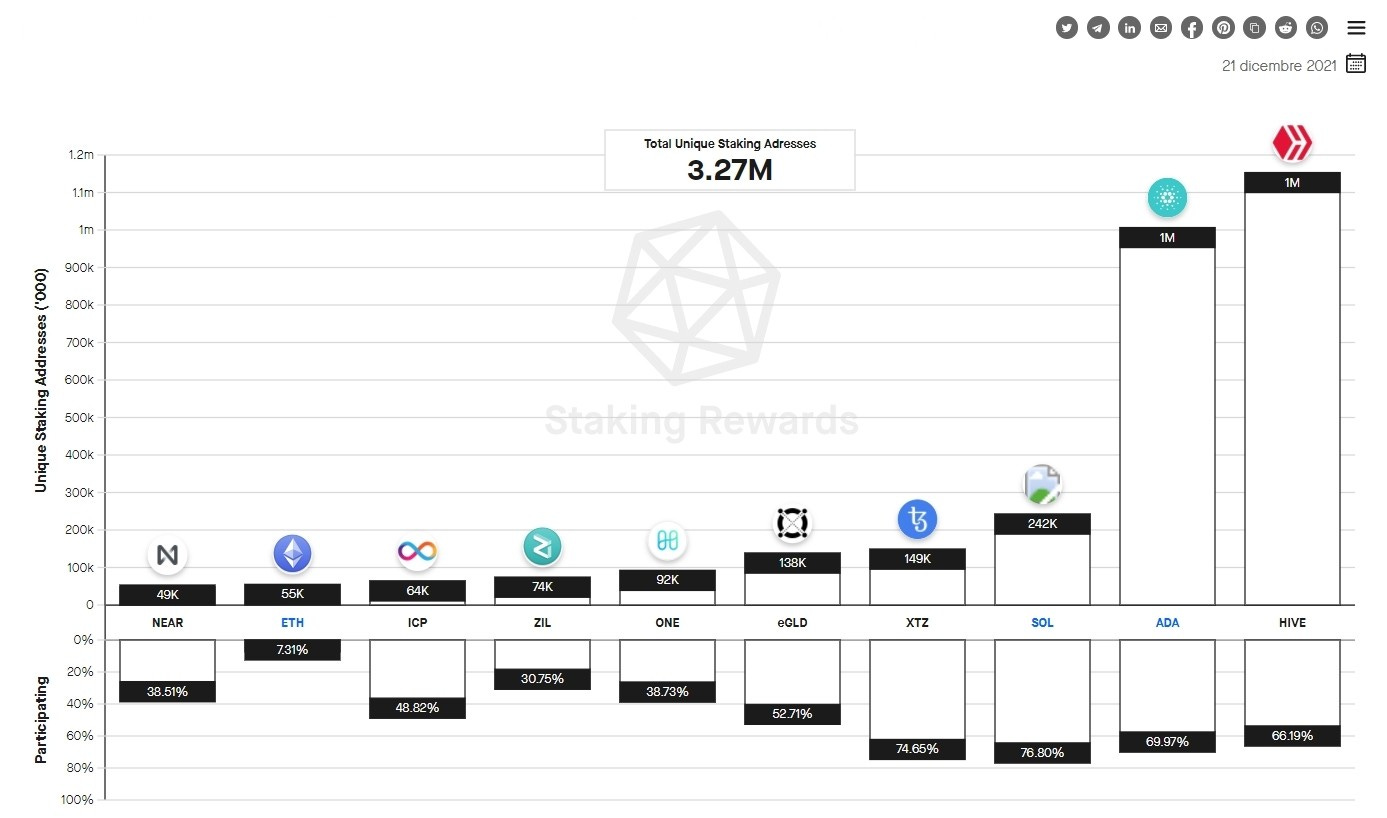

The following graph shows the top 10 Proof-of-Stake networks classified based on the number of unique staking addresses. The networks with the most exclusive staking addresses are classified at the top. The ranking provides an overview of the network with the highest retail staking participation across the entire crypto universe.

Nessun commento:

Posta un commento