Termed ‘London,’ the upgrade is expected to take place on block 12,965,000 and is one of the most crucial and anticipated developments to take place on the Ethereum blockchain since its inception in 2015.

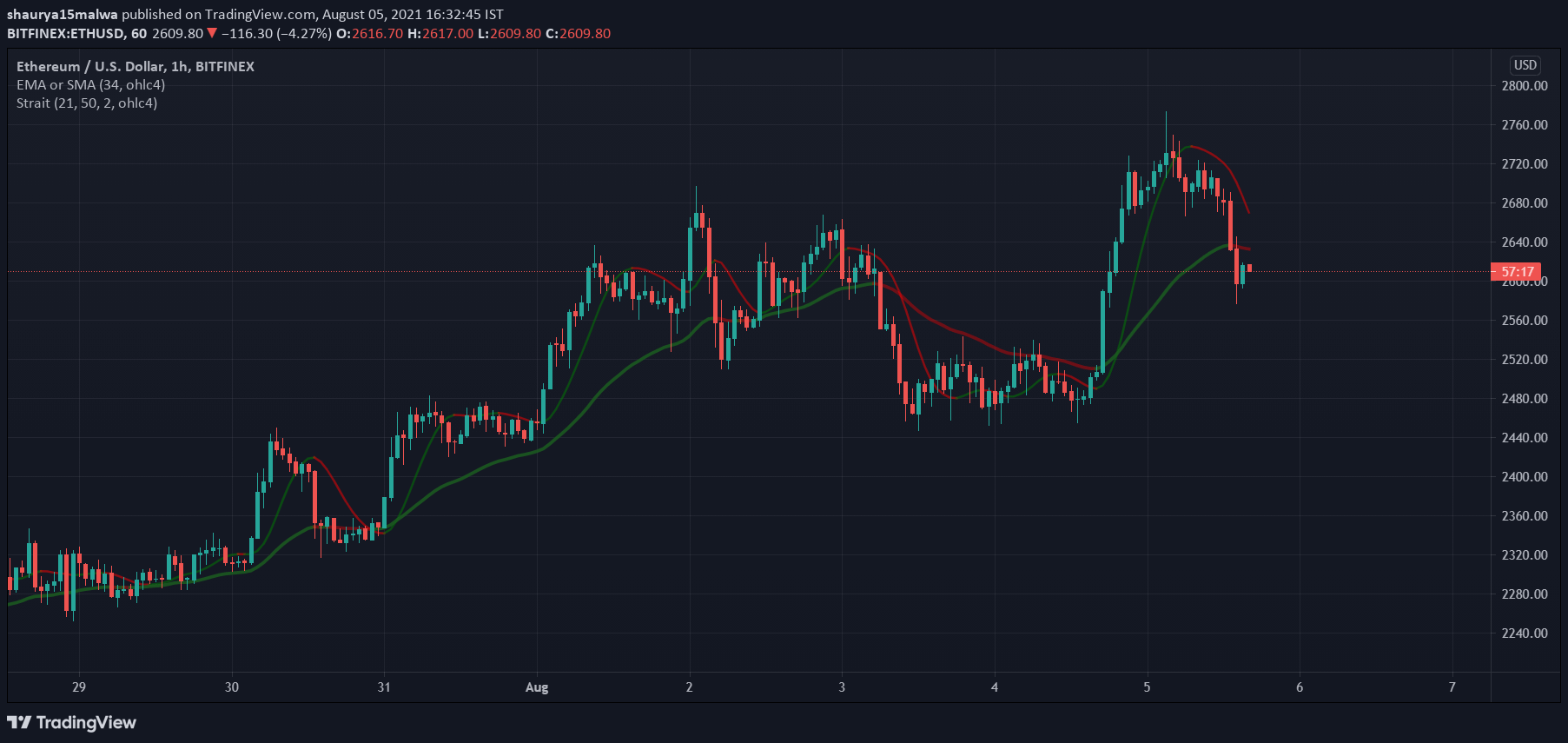

Traders placed their bets accordingly: ETH briefly traded above the $2,700 mark yesterday, before seeing a sell-off to the $2,500 level as of press time. It, however, continues to trade above its 34-period exponential moving average and has not broken the uptrend seen since the $1,700 price level, as the image below shows.

Majority of network prepared

As per FXStreet, over 75% of all live Ethereum nodes and miners are prepared for the upgrade. They must upgrade their client version to the latest to remain compatible and expect a seamless experience.

At present, users need to include a certain amount of ETH in ‘Gas’ fees to incentivize miners to approve and process their transactions—think of this as a ‘tip’ paid to miners.

This, however, creates two issues: One, users bet against each other with higher Gas fees so their transactions are included in the block and processed quickly, and two, such behavior gives rise to the Miner Extractable Value (MEV) problem—a measure of the profit a miner can make through their ability to include, exclude, or re-order transactions within the blocks they produce.

https://cryptoslate.com/ethereum-eth-jumps-then-dumps-ahead-of-crucial-eip-1559-upgrade/