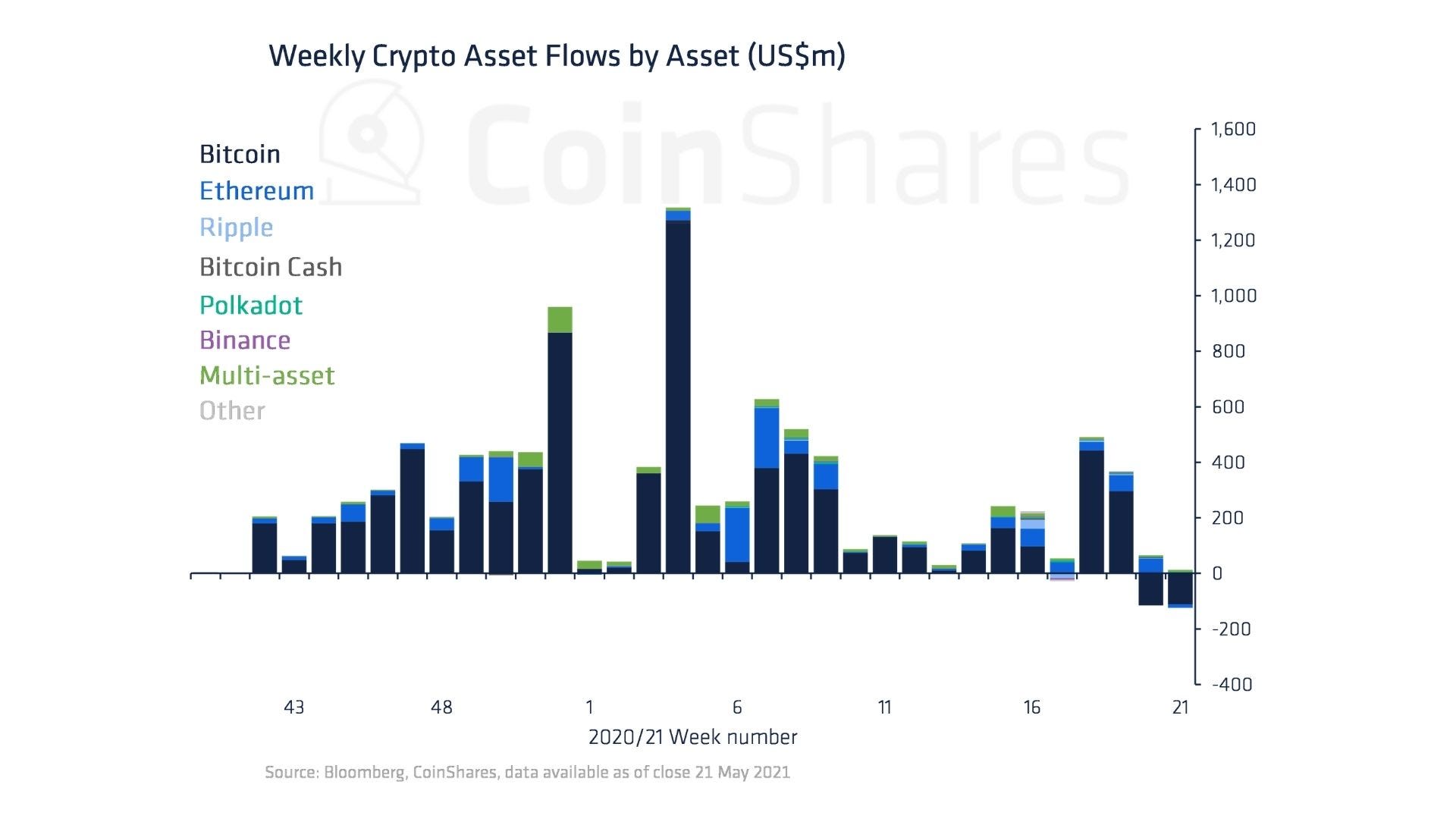

Digital asset investment products saw net outflows for the second consecutive week totalling US$97m, another new record for outflows. The outflow remains low, representing only 0.2% of total assets under management (AuM). Particularly when compared to the net inflows year to date of US$5.5bn, representing 11.8% of AuM. Regardless, it represents a net change in sentiment following increasing regulatory scrutiny and concerns over Bitcoin’s environmental credentials.

Last week saw lower outflows for Bitcoin, with outflows of US$111m versus US$115m the previous week (amended following new historical updates).

Adding to the outflow was Ethereum which saw minor outflows of US$12.6m following a long run of record-breaking inflows totalling US$924m year to date (8% of AuM).

All other altcoins (typically coins other than Bitcoin) saw continued positive sentiment with inflows across the board totalling US$27m. Cardano saw the largest inflows ofUS$10m, which may represent investors actively choosing proof of stake coins based on environmental considerations. Multi-asset and Polkadot investment products also saw inflows of US$7m and US$5.5m respectively.

Bitcoin volumes on trusted exchanges reached a record US$155bn last week.

Find the full report here: https://coinshares.com/research/digital-asset-fund-flows