LEGGI QUESTO ARTICOLO DI SEEKING ALPHA

Bitcoin ETF Approved In March 2017: A Black Swan With Asymmetric Risk/Reward

Our thesis is that the probability of a Bitcoin ETF approved in the near term has been misevaluated as a "very low chance" event by major investment and research firms.

As such, there is an attractive return/risk ratio for investors taking positions in the OTC market before March 2017.

We provide a target price of ... $3,678 for Bitcoin in case an ETF is approved in 2017 and a target price of $551 in case it is rejected this year.

We assign a probability of 35% for approval against 65% probability for rejection, making our final weighted average expected price $1645.45 or a +67.8% expected return above the current price.

As such, there is an attractive return/risk ratio for investors taking positions in the OTC market before March 2017.

We provide a target price of ... $3,678 for Bitcoin in case an ETF is approved in 2017 and a target price of $551 in case it is rejected this year.

We assign a probability of 35% for approval against 65% probability for rejection, making our final weighted average expected price $1645.45 or a +67.8% expected return above the current price.

CONTEXT - INTRODUCTION

In this analysis, we will focus on the facts surrounding an upcoming notable event: the final decision on the Winklevoss Bitcoin ETF (Pending:COIN) approval by the Securities Exchange Commission on March 11th, 2017 and the attractiveness of opening long positions before this date.

In its 8 years of existence, Bitcoin has polarized analysts, investors, and scholars. Consensus on Bitcoin's merit has not been reached, and observers usually engage in two opposed extremes of opinions that either deplore it or aggrandize it. Although its utility as a means of exchange is controversial, from a purely quantitative point of view the evidence suggests continued growth in transaction volume through the Bitcoin network, continued growth in interest from new markets, and continued growth in entrepreneurial attention. We describe the current state of the Bitcoin economy, the upcoming ETF approval chances, and the potential implications for investors.

Steady growth in transactions processed by the Bitcoin network

Transactions processed by the payment network have been growing at a stable pace for the past 5 years. This was the original use case of Bitcoin and the data indicates that it is fulfilling its goal at a current rate of ~250,000 transactions per day.

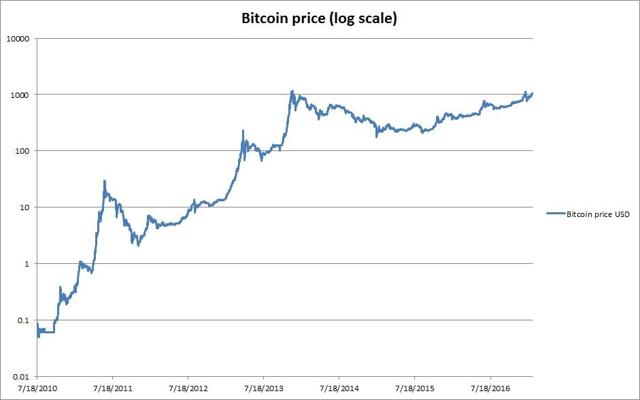

Bitcoin price near all-time high

Although the original intention of Bitcoin was to become a digital currency payment network, probably the most successful use of Bitcoin today is as a speculative vehicle. At $981 per unit and a total market capitalization of $16 billion, the cryptocurrency is heavily traded back and forth for CNY, USD, EUR, among other 26 national currencies. Just in the 30 day period of 12/24/16 to 1/22/17 the aggregate of Bitcoin exchanges have reported a combined trading volume of 154,713,805.60 BTC, or approximately $141.6 billion at today's price, an average of $4,719 million per day of trading (source: Bitcoinity.org). Since end of January Bitcoin trading volume has declined substantially in China due to new exchange fees after pressure from the Chinese central bank; however the price of Bitcoin shows robustness and keeps approaching the all time high of 2013.

Bitcoin price chart in log scale, expressed in USD - Source: Coindesk.com

Exponential growth of internet searches related to Bitcoin in high inflation countries: the case of Nigeria, Ghana & Venezuela

The appeal of Bitcoin as a kind of "digital gold" that has no borders and can be concealed easily seems to be an attractive angle for developing economies that suffer highly inflationary regimes. Based on data provided by Google, internet search volume for the keyword "bitcoin" has been growing geometrically in Venezuela, Nigeria, and Ghana during the last year, being on the list of the top 5 countries in the world with most interest on the subject. In Nigeria, the buying pressure to acquire the cryptocurrency made the price soar in the local markets to the equivalent of USD 1,730 on Jan 4th, the highest price ever recorded in Bitcoin's history (source: Luno.com).

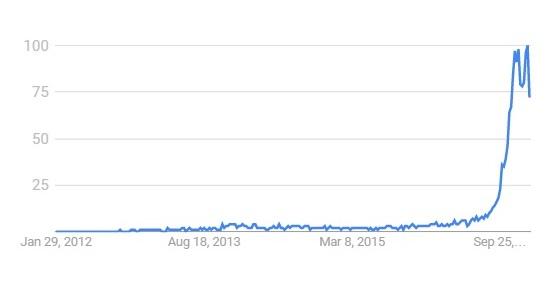

Nigeria: 15.38% CPI inflation rate (2016)

Google search volume in Nigeria 1/29/2012 to 1/22/2016, keyword "bitcoin" - Source: Google Trends

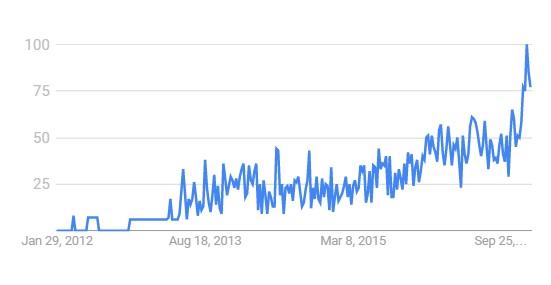

Ghana: 17.02% CPI inflation rate (2016)

Google search volume in Ghana 1/29/2012 to 1/22/2016, keyword "bitcoin" - Source: Google Trends

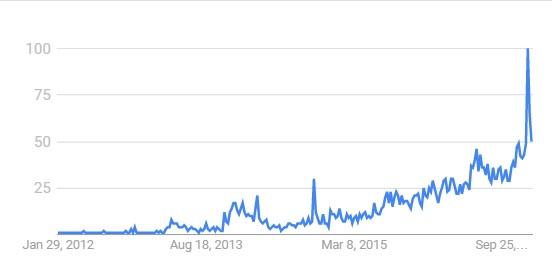

Venezuela: 475.61% CPI inflation rate (2016)

Google search volume in Venezuela 1/29/2012 to 1/22/2016, keyword "bitcoin" - Source: Google Trends

WHY THE BITCOIN ETF IS CLOSER TO REALITY THAN WHAT THE MARKET CONSENSUS IMPLIES

Our main argument in favor of taking positions in Bitcoin is sustained on five pieces of evidence that cover regulation, insider knowledge, market forces, competitive actions, and political considerations. We believe this evidence has not been described in the past by mainstream investment and research firms while analyzing it now provides an edge to take profitable positions.

Exhausted terms by SEC in the approval process of the first Bitcoin ETF - Inaction by SEC in March '17 will approve de-facto the ETF

The rule-change application of COIN was submitted on July 2nd 2016, after almost three years of preparation with previous SEC filings. The SEC has consecutively requested three extensions to make a decision: the first one was in September '16, another in November '16, and the last one in January '17. Based on the timelines described in the SEC response, the last date for approval or disapproval of the rule-change is March 11th 2017, date after which the ETF would be approved by default if the SEC does not communicate a decision.

Applicant of the first Bitcoin ETF taking steps that indicate positive SEC consideration

The Winklevoss brothers are behind the COIN ETF application. We identify several steps they have publicly taken that might indicate progress in conversations with SEC or at least their aligned involvement as promoters:

- On Feb 19th, 2014 the Winklevoss brothers created Winkdex, an index to track Bitcoin prices that is now divulged by major financial information vendors as Bloomberg and Reuters. This could be a pre-requisite for information transparency.

- Since Jan 23rd, 2015 they are now operating a Bitcoin spot exchange (Gemini.com) based in New York that is fully operates under US law. It is plausible that their intention is to source liquidity for their Bitcoin ETF through their own spot exchange. This could be a pre-requisite for orderly trading, liquidity access, and capital formation.

- Through Gemini.com, on Sep 21st, 2016 they created a daily auction process to settle the Bitcoin price once a day. This could be a pre-requisite for fair market price fixation.

- On Dec 8th, 2016, the Winklevoss brothers inaugurated a website specifically for investor relationship management and promotion of the COIN ETF. Taking action to launch the ETF website after 3 years of conversations with the SEC might be indicative of a change of perception of the twins, pointing to their optimism.

- On Feb 8th, 2017, the Winklevoss brothers communicated to the SEC that they had secured the services of three of the largest high frequency trading firms to provide liquidity and efficiency to the COIN ETF: Convergex, KCG, and Virtu Financial.

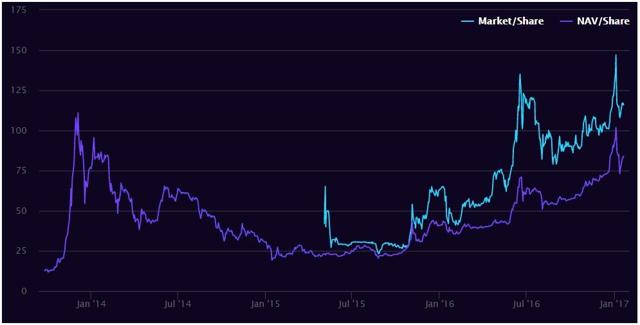

Premiums on closed-end fund GBTC suggest the SEC might step up to benefit market function with an open-end ETF

The Bitcoin closed-end fund GBTC floats on the OTCQX exchange with notorious premiums. In the past few years, there have been sessions where the GBTC market prices have reached up to 2x-3x net asset value (NAV). The fund has closed every week since inception significantly above NAV. GBTC has been wildly successful as an investment vehicle delivering returns in the triple digits to investors, but the closed-end nature of the fund is presenting friction to market participants and an ETF would be a more efficient tracker of the underlying asset.

GBTC market price per share vs NAV per share - Source: Grayscale Investments

More than one chance: three Bitcoin ETFs are under consideration by the SEC

The Winklevoss Bitcoin Trust started the application process with the SEC almost four years ago but only last year it entered into the realm of possibilities with its application for a rule-change for the BATS exchange. However it is not the only candidate to materialize a publicly traded ETF:

- SolidX Bitcoin ETF (XBTC) applied to become publicly traded on NYSEArca on June 22nd, 2016, being the approval SEC deadline on March 30th, 2017. The main peculiarity of this vehicle is its proposed 100% insurance on holdings.

- Grayscale Bitcoin Investment Trust ETF (OTCQX:GBTC) applied to modify its current status from a closed-end fund (traded on OTCQX) to an open-end ETF (on NYSEArca) on January 20th, 2017, and by end-October 2017 the SEC should communicate its final decision.

Heavy pro-Bitcoin presence in President Trump's Administration leans the balance towards a higher chance of a Bitcoin ETF approval

The Trump Administration is well known for its anti-regulation stance, as it was seen with the Dodd-Frank Act repeal. There are multiple pro-Bitcoin enthusiasts involved in some way or another with the current US administration, including Mick Mulvaney (director of the U.S. Office of Budget nominee), Peter Thiel (Paypal co-founder), Balaji Srinivasan (21.co CEO and potential FDA director nominee), Travis Kalanick (UBER CEO), and others. Trump's entourage leans the balance towards a more accepting perspective for Bitcoin.

WHY THE BITCOIN ETF WILL DELIVER IMMEDIATE RETURNS FOR BITCOIN HOLDERS

We propose the case for a massive increase in the accessibility of Bitcoin as an investment asset class if an open-end style fund like the Bitcoin ETF starts trading on a major equity exchange and how this new disponibility will grow the returns of Bitcoin investors.

Buying pressure on the Bitcoin ETF will shift the demand curve of Bitcoin's digital tokens

As per the SEC filing, every 10,000 units of the ETF can be redeemed or exchanged for the underlying. The COIN ETF shares will impact demand of spot bitcoins through their interchangeability.

If Bitcoin is currently a $16 Billion technology startup, the ETF will be equivalent to its IPO

Currently, Bitcoin trading is dominated by OTC exchanges that operate under no explicit guidelines. A move into public exchanges will deliver:

- Guarantee of regulatory oversight for investors

- Qualitative increase in visibility as an asset class

- More credibility in the financial scene

- Further consideration and analysis of its technical capabilities

As Bitcoin has achieved its current multi-billion market value without access to organized financial markets, we foresee great interest in case it becomes publicly traded in the form of an ETF.

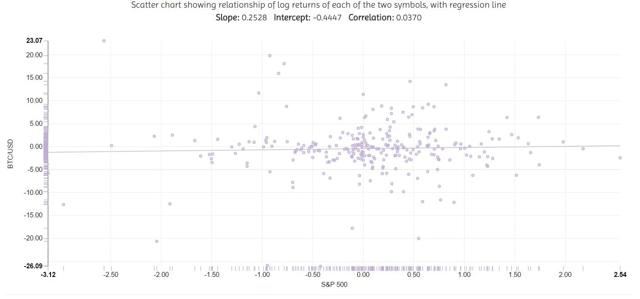

Useful or not as an actual currency, Bitcoin will be used as a diversification asset

Independently of its merits as a technology or financial innovation, Bitcoin excels as a lowly correlated asset against major asset classes (see Ark Investments 2017). As such, it has a place in modern portfolio management. For as long as the Bitcoin network continues to find use in the developing world, underground markets or even collectible memorabilia, this emerging asset class will continue attracting investors looking to reduce portfolio beta.

Bitcoin exhibits a 0.037 correlation with S&P 500 on 30 day returns

Because hedge funds ($2.7 trillion assets under management) and endowment funds ($1.4 trillion AUM) are sophisticated players inclined to zero beta multi-asset portfolios, they will be the least hesitant to take positions to achieve lower return correlation with equities. After them, other sophisticated investors will follow.

The Bitcoin ETF will invite the entrance of significant amounts of capital, while the event is not accompanied by more units in circulation

The supply curve is fixed in the Bitcoin protocol to a maximum total emission of 21 million bitcoins, a circulation to be reached in 2130. The current volume of bitcoins in circulation stands at 16,119,688 BTC units (source: Blockchain.info) and the rest up to the maximum 21 million would be issued following a logarithmic schedule that enforces limited supply for Bitcoin.

To manipulate or sabotage the supply of Bitcoin and place more units in circulation, a malicious actor would need to out-invest the Bitcoin network computational power, which currently stands at 3,398,970 Tera hashes per second (source: Blockchain.info). With last generation supercomputing hardware (NVIDIA Tesla S2070 GPU parallel processors), the total investment needed to reach the required computational power to change the supply stands at $150 billion. With custom-made specialized hardware (i.e. made-to-order by a semiconductor fab like TSMC or Samsung), the cost could be reduced to a few billion dollars as per industry experts. Based on these data points, we consider unlikely any change in the Bitcoin issuance schedule.

TARGET PRICE RECOMMENDATION

Our recommendation is to allocate anywhere between 0.2% and 5.0% of portfolio to Bitcoin using an OTC spot exchange. Avoid using the closed-end fund GBTC as it trades at substantial premium vs NAV.

In case of approval of a BTC ETF, our estimated target price for Bitcoin is $3,678. The estimate is based on the calculations of Needham Company of $300 million influx in the first week of trading of the fund together with our assessment of Bitcoin's top 8 spot exchanges' order book depth as per BitcoinCharts.com 3-month historical order depth data.

In case of rejection by the SEC, our estimated target price for Bitcoin is $551, calculated on the basis of a mean reversion scenario for which we used the weighted average of the last 5 years of prices of Bitcoin as per BitcoinAverage.com data.

VARIANT VIEW

It seems unlikely, among all the other reasons, that the commission is going to want to move forward with a product where the major trading is done on exchanges [in China] that may not be following our AML guidelines.

-- David Brill, former General Counsel of Gemini.com in Coindesk.com interview 1/20/2017

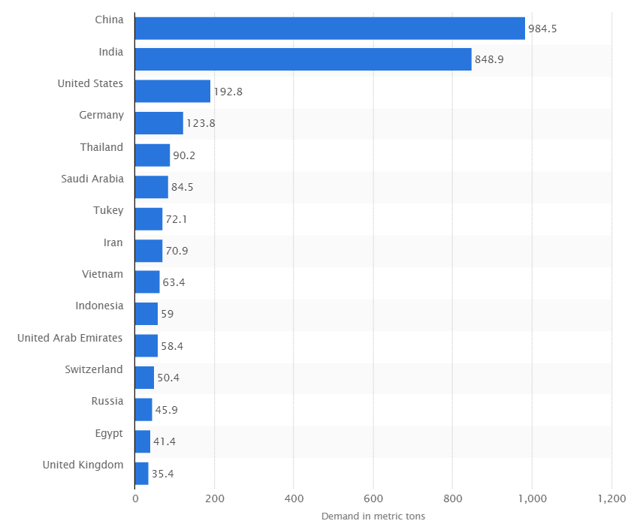

Our counter-argument to this view is that the vast majority of OTC gold purchase transactions are happening also in China and India, with combined purchase volume 9.5x larger than the US. Consumer gold has no AML guidelines and can be acquired without identification requirements in retail shops. These conditions did not present an obstacle to the SEC for the approval of the first gold ETF (NYSEARCA:GLD) on 2005, and thus we believe the SEC will follow the same guidance with Bitcoin.

In parallel, there is strong indication that the Chinese central bank and regulatory organisms requested as recently as Feb 8th 2017 an immediate enforcement of anti-money laundering procedures on all major Chinese Bitcoin exchanges.

CONSUMER GOLD PURCHASES IN 2015

Consumer purchases of gold by country in 2015 - Source: Statista.com

CONCLUSION

The probability of approval for a Bitcoin ETF is higher than what the current market consensus implies. We consider this event a potential Black Swan that will have a profound impact in the investment world. Critical dates for the near term are March 11th (COIN ETF Security Exchange Commission's decision deadline), March 30th (XBTC ETF decision) and October (GBTC ETF decision). In case of ETF approval we predict a large upside, while in case of rejection the losses could be limited to 50% of the capital. Our recommendation is speculative buy of Bitcoin spot on OTC exchanges before March 11th, 2017 and hold at least until October 2017.

Disclosure: I am/we are long BITCOIN.

http://ilpunto-borsainvestimenti.blogspot.it/2017/02/bitcoin-3678-dollari-entro-meno-di-un.html