The altcoin bubble is in full force and is creating a lot of buzz and euphoria in the crypto space. Some may argue it’s not a bubble and smart money is flowing into the space, Bitcoin is losing its position to altcoins, the world has finally acknowledged the value of cryptocurrencies and so on. But most people are probably just theorizing on little evidence and have no idea what’s really causing this bubble. I think I know the answer now. Newly entering Japanese investors are driving this great altcoin bubble and not-so-smart money is flowing into the space especially into some altcoins at a rather concerning rate.

What’s happening now?

The past few weeks especially, the crypto space has been seeing an unprecedented bull run across almost all coins. Despite the never ending debates and politics within the Bitcoin community over the scaling debate, the bitcoin price has climbed up to all time high all the way over $1700 and it looks like it may go even higher from here. While the Bitcoin price increase alone is very impressive, many other altcoins such as Ether and XRP are making even more killings and their prices increased 5 or even 10-fold in mere several weeks.

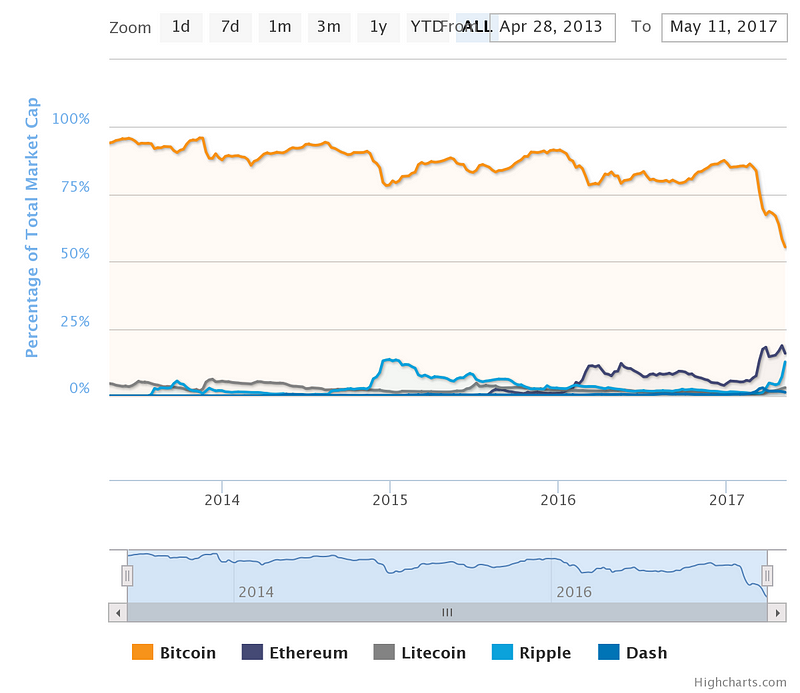

While this crazy bull run has pushed up the entire cryptocurreny market cap to more than 50 billion dollars quickly for the first time according to the coinmarketcap.com, the Bitcoin dominance rate has sharply fallen to the all time low now nearing 50%. Some altcoiners are pointing it out as a legitimate trend and some even started gloating victoriously that “Bitcoin is dead and altcoins (or whatever coin they own) will take over from here”

All the above is no secret and everyone in the space knows that already. But what the heck is really going on and what’s causing this altcoin bubble? Is it something we(bitcoiners) should be worried about? If you understand what’s happening in Japan, the whole picture becomes a bit clearer.

New era of cryptocurrencies in Japan

As predicted in my previous post in the beginning of this year, Japan has become the world’s biggest bitcoin trading market after the sudden drop of liquidity in the Chinese market. According to Coinhills, the JPY-BTC market is ranked first ahead of the USD market and now accounts for more than one third of the world’s total trading volume on average. In fact, the prediction was not a difficult one to make although it has happened much sooner than I anticipated. There were a lot of indications that risk loving investors and serious institutional players were looking to enter the crypto market since last year in Japan.

The biggest and direct cause for this seemingly sudden boost is the new cryptocurrency regulation which went effective in April and with the official stamp of approval from the higher authority, an entirely new wave of Japanese people started rushing to cryptocurrencies.

Japan is known for its homogeneous culture and the key to adoption of anything is whether people perceive that “everyone else is doing it” or not. So, obviously, it seems we have passed the tipping point in Japan and now it’s suddenly completely “OK” to hop onto the crypto train and people started assuming it’s safe to invest in them because “everyone else is doing it”. Major Japanese cryptocurrency exchanges such as bitFlyer, coincheck and Zaif are onboarding thousands of users every day now and I predict the JPY dominance will even go further in the near future.

Altcoin popularity and abundance of not-so-smart money

So the Japanese crypto space is experiencing an extraordinary rate of growth and more users and thus more money are flowing into the space. This is already one piece of evidence on how Japanese are leading this bubble but there are even more interesting twists to it.

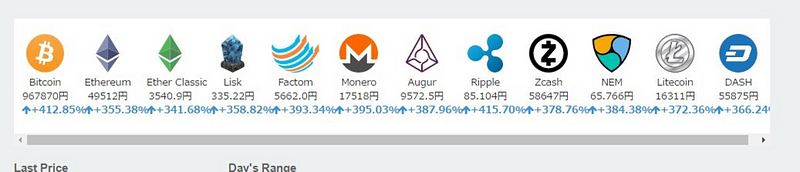

First, one of the unique characteristics of the Japanese crypto space is that altcoins are very popular as a means of investment and some of them have very strong and dedicated communities; some even more active than the Bitcoin community itself in a way. Among them, two of the most popular altcoins in Japan are XRP(Ripple) and XEM(NEM).

XRP has been popular for a long time in Japan for whatever the reason. Maybe it’s because major Japanese banks are experimenting with Ripple technology and people here tend to have a lot of faith in banks and large institutions Ripple Labs is partnering with in Japan.

On the other hand, NEM is popular thanks to the strong backing of the platform from the Zaif exchange, one of the biggest exchanges in Japan along with bitFlyer and coincheck. NEM’s private blockchain solution developed by Zaif with NEM’s core developers is called MIJIN and it has established itself as a strong brand in the crypto space in Japan.

The point here is not to debate whether those coins are superior to Bitcoin or offer any utility at all but rather is the fact that they have strong local communities in Japan and a lot of information(and misinformation) regarding those two coins particularly have been translated and made accessible to even beginners.

So, it’s natural to suspect a lot of the new money from Japan are flowing into those coins and coincidentally(or not) two of the hottest coins in terms of price appreciation as of late are XRP and XEM. They are currently ranked 3rd and 5th respectively in terms of the market cap as of this writing.

(Ethereum is pretty popular in Japan like any other countries by the way but XRP and XEM are unique phenomena in the Japanese market)

(Ethereum is pretty popular in Japan like any other countries by the way but XRP and XEM are unique phenomena in the Japanese market)

Another thing to note about this new trend is that the general lack of understanding or appreciation of the technology by many of new users. This is no surprise and all of us have been there at one point but the new wave of Japanese investors seem to be exhibiting a whole new level of incomprehension and misguided decision making in my opinion. Many of them don’t bother researching what those coins do nor what they are useful for but rather follow whatever they hear in exchanges’ chatrooms(the worst place for investment advice literally…)

One funny episode I can share to describe the level of understanding is that I heard someone was spreading misinformation in a chatroom that this rich foreigner called “Mr. SegWit” is buying up a lot of Litecoin now and that’s why the price of Litecoin is going up and likely go even higher. And ironically, some people really do believe this kind of nonsense and jump onto the bandwagon without thinking much! It’s just absurd beyond hilarious.

In short, I, along with other Japanese community members, had a strong suspicion that these inexperienced Japanese investors were leading the whole altcoin bubble, where even some shitcoins without any use cases or viable products increase 5-fold for seemingly no reason. Then, this week’s incident at coincheck cemented this suspicion.

Coincheck goes down and everything becomes so obvious

Looking at the charts, the prices of XRP and XEM jumped up significantly on May 8th right after “Golden Week” in Japan, one of the biggest holidays of the year for Japanese salarymen. It made a lot of sense as bank transfers are restricted during holidays (of course) and May 8th(Mon) was the first business day after Golden Week and a lot of money arrived at crypto exchanges.

Then the following day, something made it even more obvious. Coincheck, which is sort of like Japanese Poloniex with the biggest altcoin listing, halted their service abruptly in the morning of May 9th after the bitcoin price at the exchange reached over 10k USD in a matter of few minutes along with unnatural price increases across all altcoins listed.

(The cause of this malfunction is yet officially unknown and coincidentally Poloniex went down around the same time but the cause of this is not the main point of contention here, so I’ll skip that part)

This caused chaos and altcoin prices started dropping sharply by more than 20% at other exchanges, leaving many new Japanese users confused and angry. Then after a few hours from the accident, coincheck announced that it was rolling back the system to the pre-accident state and shortly after, they resumed all the trading except XRP purchase.( XRP delisted temporarily due to liquidity shortage according to the official announcement)

This led to a rather fascinating turn of events. Lots of those new users were upset but their appetite for trading stayed strong and in the absence of XRP, many of them turned to other altcoins like XEM, Litecoin and Ether. Surely, the XEM price went up quickly after coincheck went back up as the chart below indicates.

(The conversations and shilling which were happening in the coincheck’s trollbox at the time were “very very interesting” to say the least)

(The conversations and shilling which were happening in the coincheck’s trollbox at the time were “very very interesting” to say the least)

Then guess what happened next? The following day, on May 10th, right after coincheck re-enabled XRP purchase, the price of XRP shot up quickly, “investors” shedding tears of joy.

At this point, there was little doubt for everyone in Japan as to what was driving this altcoin bubble.

Key takeaways

What’s happening in Japan now is rather unique and is an unforeseen territory for the crypto community as a whole in my opinion. On one side, it’s great that we are approaching mainstream adoption of cryptocurrencies thanks to regulatory clarity unlike any other countries and an entirely new group of people is entering the market, bringing with them more liquidity and attention to the space.

On the other hand, there is a number of people including myself who are worried about this unsustainable rate of growth and mutation of the community. The level of understanding among crypto investors is at all time low while exchanges are not quite ready to accommodate such a huge uptick and continue to stumble into major issues rather frequently, causing nightmares and disappointments to new users.(Bitcoin’s ever increasing tx fees are not helping here, either)

Furthermore, people are in it for quick profits and don’t seem to be interested in understanding technical or social aspects of cryptocurrencies at all. Many don’t even know what a “wallet” or “private keys” are yet while dumping lots of money on some coins. I can already see many accidents and tragedies happening to those new users unfortunately…

Another takeaway is that considering what’s happening in Japan right now, I’d predict more not-so-smart money will continue to flow into certain altcoins. The main argument here is not whether those altcoins will have any technical or practical merits but rather the mere fact that the new investors in Japan are more attracted to more volatile and riskier altcoins rather than slightly more stable and established Bitcoin, dreaming of becoming a millionaire in a few weeks.

If this is what’s really happening and what will continue to happen, I don’t know if the metric like the Bitcoin domination rate(bitcoin vs all other altcoins combined market ratio) is any good measure to indicate the true value or usefulness of cryptocurrencies.

Sure, you may argue that this has been always the case for any cryptocurrencies and speculation eventually brings real users and values. However, my feeling after observing those new entrants is that that’s just not the case. While some altcoins will provide some real utility and may possibly challenge or even overtake Bitcoin in the future, the current altcoin price increases are not providing any direct evidence for increased usage or real demand my opinion. If anything, it validates skeptics’ view that cryptocurrencies are only good for speculation.

Lastly, if you are a cryptocurrency trader, there will be ample opportunities ahead thanks to a new type of hungry and inexperienced Japanese investors. Whoever wishes to be ahead of the trend cannot (shouldn’t) ignore the Japanese market anymore. Unfortunately, however, what’s happening in Japan mostly stays here due to a huge language and cultural barrier and historically Bitcoin media have done a terrible job reporting accurate and useful information on the market in my opinion. (So good luck using Google Translate a lot!)

In conclusion

I have predicted the Japanese takeover of the crypto trading market before and my next prediction would be more severe price swings for altcoins led by the Japanese market in the coming months. I don’t think this is sustainable and the bubble will pop eventually without a doubt. I don’t know when exactly that will happen but I know Japanese will play a big role in it.

I’m not even a trader myself and I don’t even care if my portfolio value goes up or down in the short term. To be quite honest, I am a bit tired of short-sighted and meaningless conversations happening in the space now.

It’s true that cryptocurrencies in general are getting closer and closer to mainstream adoption and it’s sort of exciting for me to know that Japan is the forefront of the trend. But, obviously, it’s not all roses and there is a fair dose of concerns about the whole situation. Nonetheless, Japan is providing an intriguing case study as to what mainstream adoption will look like for cryptocurrencies and maybe there will be some valuable lessons which the rest of the world can learn from.

Nessun commento:

Posta un commento